The 2 loans may even have various financial debt-to-earnings ratio thresholds and also other one of a kind requirements. Familiarize your self While using the two sets of skills To make certain you satisfy them equally.

LTV isn't going to continue to be at the exact same exact level. If your house value rises or falls, then your LTV will likely not keep on being static.

Bankrate best provides represent the weekly average desire fee amid leading features within just our charge desk to the loan form and time period chosen. Use our rate table to see individualized premiums from our nationwide marketplace of lenders on Bankrate.

Keep in mind that after you submit an application for an 80/ten/ten home loan, you’re actually implementing for two loans at the same time. You need to qualify first for Most important home loan in addition to a household fairness line of credit history (HELOC). Which makes qualifying for your piggyback loan slightly more durable than qualifying for only one mortgage. Such as, there's a chance you're in the position to get a standard loan for eighty% of the house’s worth by using a credit score of just 620.

Some customers may also get USDA loans or VA loans which call for no money down, although not everyone is suitable. USDA loans have revenue and geographical restrictions; VA loans are reserved for navy service customers.

Pursuing a piggyback loan involves extra operate when purchasing a residence as you’re applying for and shutting on two loans simultaneously. Right here’s what to expect from the method:

There are a number of loan applications especially geared toward homeowners with higher LTV ratios. There are actually even some plans which disregard loan-to-price entirely.

Homebuyers from time to time use piggyback property loans for a workaround to some twenty% deposit. Usually, borrowers must pay out for personal mortgage insurance plan (PMI) when they set down under twenty% on a house buy.

HELOC A HELOC is a variable-fee line of credit history that allows you to borrow funds for just a established period of time and repay them afterwards.

Rocket Home loan® is a web based mortgage expertise produced by the business previously generally known as Quicken Loans®, The usa’s major home loan lender. Rocket click here Property finance loan® causes it to be uncomplicated to acquire a home finance loan — you only notify the corporate about you, your private home, your funds and Rocket Mortgage loan® offers you actual interest rates and figures.

In order to avoid a jumbo loan. A piggyback property loan might help you buy a residence earlier mentioned conforming loan restrictions with out borrowing a jumbo loan with bigger fascination premiums and stricter prerequisites.

A co-signer is somebody that claims to repay your debt if you default, and their very good credit score backing the loan could help your approval odds. A co-borrower is someone that borrows dollars along with you which is equally accountable for building regular payments.

Another choice should be to get out PMI. Your lender or property finance loan may work with you to search out an insurance company in this article. You will typically have to carry the insurance policies and pay back the quality right until the harmony over the mortgage is at most eighty p.c of the house benefit.

Credit rating unions can have membership restrictions for loans plus some banks Restrict personal loans to current clients, which means you’d have to open up a checking account to qualify.

Tia Carrere Then & Now!

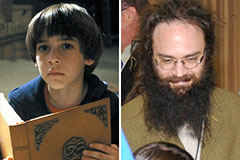

Tia Carrere Then & Now! Barret Oliver Then & Now!

Barret Oliver Then & Now! Tiffany Trump Then & Now!

Tiffany Trump Then & Now! Elin Nordegren Then & Now!

Elin Nordegren Then & Now! Daryl Hannah Then & Now!

Daryl Hannah Then & Now!